Netflix Stock: Netflix Inc. (NASDAQ: NFLX) has transformed from a small DVD rental service into a global streaming giant, capturing the imaginations of millions and disrupting the entertainment industry. This article explores the evolution of Netflix stock, its historical performance, influential factors behind its fluctuations, and future prospects in the competitive streaming market.

The Beginnings: DVDs to Streaming Evolution

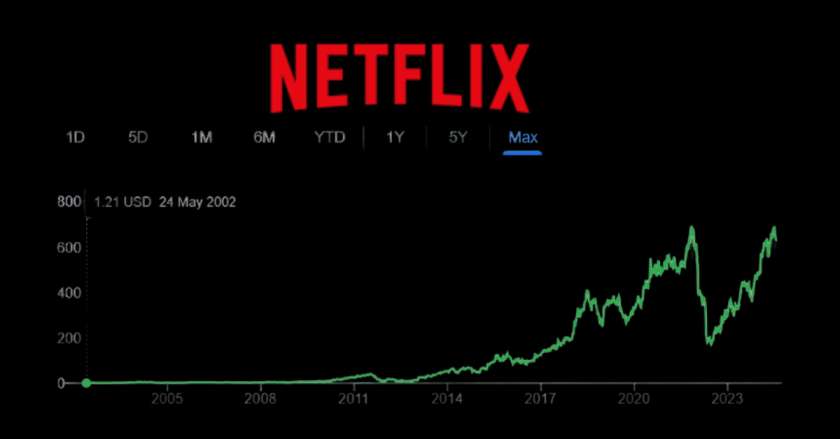

Founded by Reed Hastings and Marc Randolph in 1997, Netflix revolutionized movie rentals with its DVD-by-mail service, eliminating late fees and offering an extensive selection of titles. This innovative approach gained rapid popularity, and in 2002, Netflix went public with an initial public offering (IPO) at $15 per share. The company’s early success laid the groundwork for its transformation into a streaming powerhouse.

The watershed moment arrived in 2007 when Netflix introduced streaming video, forever altering its business model and the entertainment industry. By offering instant access to a vast library of content, Netflix capitalized on the growing demand for on-demand entertainment, setting the stage for significant growth.

Ascending to Dominance: 2010-2020

The 2010s were pivotal for Netflix, marked by a strategic shift towards original content production. The release of “House of Cards” in 2013 signaled Netflix’s commitment to creating exclusive content, distinguishing itself from competitors and attracting millions of subscribers.

Netflix’s stock price mirrored this success, soaring from around $20 in 2010 to over $500 per share by 2020. Several factors fueled this meteoric rise:

- Subscriber Growth: Global expansion strategies resulted in a substantial increase in subscribers, reaching over 200 million worldwide by 2020.

- Original Content: Investing billions in original content paid off, with hits like “Stranger Things,” “The Crown,” and “Narcos” driving subscriber growth and brand loyalty.

- Technological Innovation: Continuous improvements in streaming technology ensured a seamless user experience across devices, maintaining Netflix’s competitive edge.

- Market Adaptation: Netflix’s ability to adapt to market trends, such as the shift from linear TV to on-demand streaming, solidified its leadership in the entertainment industry.

Navigating Challenges: 2020-Present

Despite impressive growth, Netflix has faced challenges that have impacted its stock performance. The COVID-19 pandemic initially boosted demand for streaming services, but this was followed by a period of volatility.

- Increased Competition: The streaming market has become increasingly crowded, with new entrants like Disney+, HBO Max, and Amazon Prime Video vying for viewers, raising concerns about Netflix’s market dominance.

- Content Costs: The expense of producing high-quality original content has skyrocketed. While these investments drive subscriber growth, they also pressure profitability.

- Subscriber Saturation: In mature markets like the U.S., subscriber growth has slowed, prompting questions about future growth potential.

- Market Sentiment: Investor sentiment can be volatile, and Netflix stock has experienced significant fluctuations in response to earnings reports, subscriber numbers, and broader market trends.

Financial Performance and Stock Analysis

As of mid-2024, Netflix stock trades around $450 per share, reflecting a market capitalization of approximately $200 billion. Despite a decline from its peak in late 2021, Netflix remains a strong performer in the tech and entertainment sectors.

Netflix’s annual revenues exceed $30 billion, but the company faces pressure to maintain profitability while heavily investing in content and technology. Analysts hold mixed views on the stock’s future prospects, with some optimistic about international growth and others wary of increased competition and rising costs.

Future Outlook: Innovation and Adaptability

Netflix’s future success will hinge on its ability to innovate and adapt. Several key areas will shape its future:

- International Expansion: Emerging markets offer significant growth opportunities. Netflix’s investments in local content and partnerships will be crucial in capturing these markets.

- Ad-Supported Models: Introducing ad-supported subscription tiers could attract cost-sensitive consumers and provide a new revenue stream.

- Technological Advancements: Continued innovation in streaming technology, including advancements in AI for content recommendations, will enhance the user experience and maintain subscriber engagement.

- Content Diversification: Expanding its content library to include more genres and formats, such as interactive content and gaming, can attract diverse audiences and reduce churn.

Conclusion

Netflix stock’s journey from a DVD rental service to a global streaming leader is a remarkable story of innovation and market disruption. While the future holds challenges, Netflix’s track record of adaptability suggests it will continue to be a significant player in the entertainment industry. Investors must closely monitor market dynamics, competitive pressures, and strategic initiatives to navigate the future of Netflix stock.